november child tax credit date

The stimulus check part of President Joe Bidens child tax credit plan will. The Child Tax Credit was to be expanded for five years until 2025 but now the end of 2022 will be the deadline.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

The IRS is scheduled to send the final.

. It also lets recipients unenroll from advance payments in favor of a one-time credit when filing their 2021 taxes. 15 is also the date. The taxpayers that have eligible children under the age of 6.

The United States federal child tax credit CTC is a partially-refundable a tax credit for parents with dependent children. The Internal Revenue Service will soon start sending out the advanced payments of the child tax credit for November. However the deadline to apply for the child tax credit payment passed on November.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. IR-2021-201 October 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their. The full child tax credit benefit is eligible for incomes up to 75000 for individuals 112500 for heads of household and 150000 for married couples.

Low-income families who are not. Alberta child and family benefit ACFB All payment dates. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040.

Your next child tax credit payments could be worth 900 per kid Credit. The due date for opting out of the December 15 monthly child credit payments is almost here. Instead of calling it.

The future of the expanded Child Tax Credit program remains in limbo amid negotiations over scaling back President Joe Bidens 35 trillion. NOVEMBERs child tax credit cash will be sent out to parents in need across the country next week. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly.

It provides 2000 in tax relief per qualifying child with up to 1400. The deadline for the next payment was November 1. Most parents automatically get the enhanced credit of up to 300 for each child up to age 6 and 250 for each one ages 6 through 17.

Getty For qualified families who opted for paper checks those will begin to hit mailboxes through the. This measure was to coax the vote of Senator Joe Manchin a. The last opt-out deadline for.

Final Child Tax Credit Payment Opt-Out Deadline is November 29. The couple would then receive the 3300 balance 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child as part of their 2021 tax refund. Wait 10 working days from the payment date to contact us.

The fifth payment date is. IR-2021-222 November 12 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly.

The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day. The fifth advance child tax credit CTC payment is being disbursed by the IRS starting Monday sending an estimated 15 billion to around 36 million families the agency.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

Child Tax Credit 2021 8 Things You Need To Know District Capital

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Families Need To Know About The Ctc In 2022 Clasp

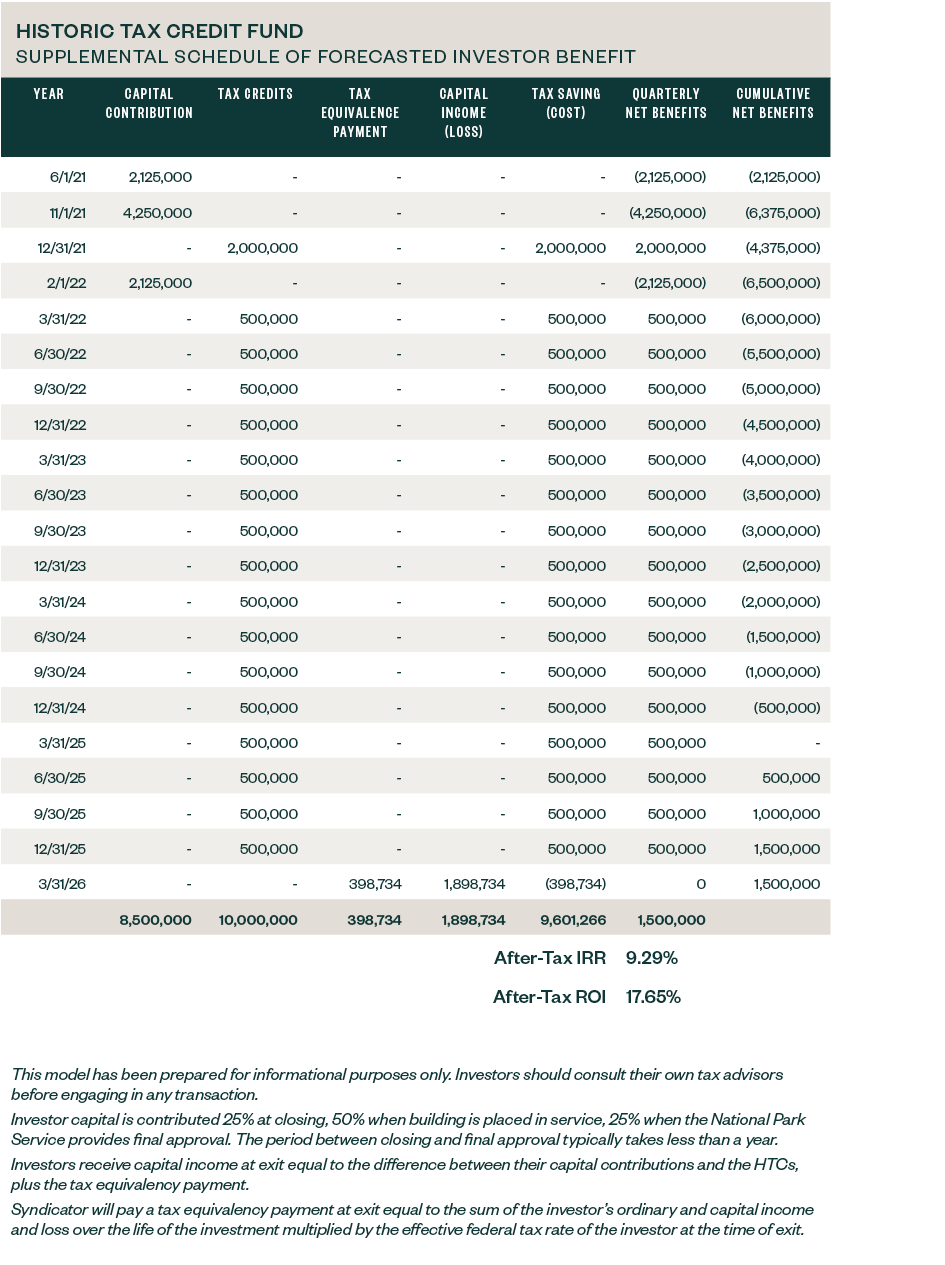

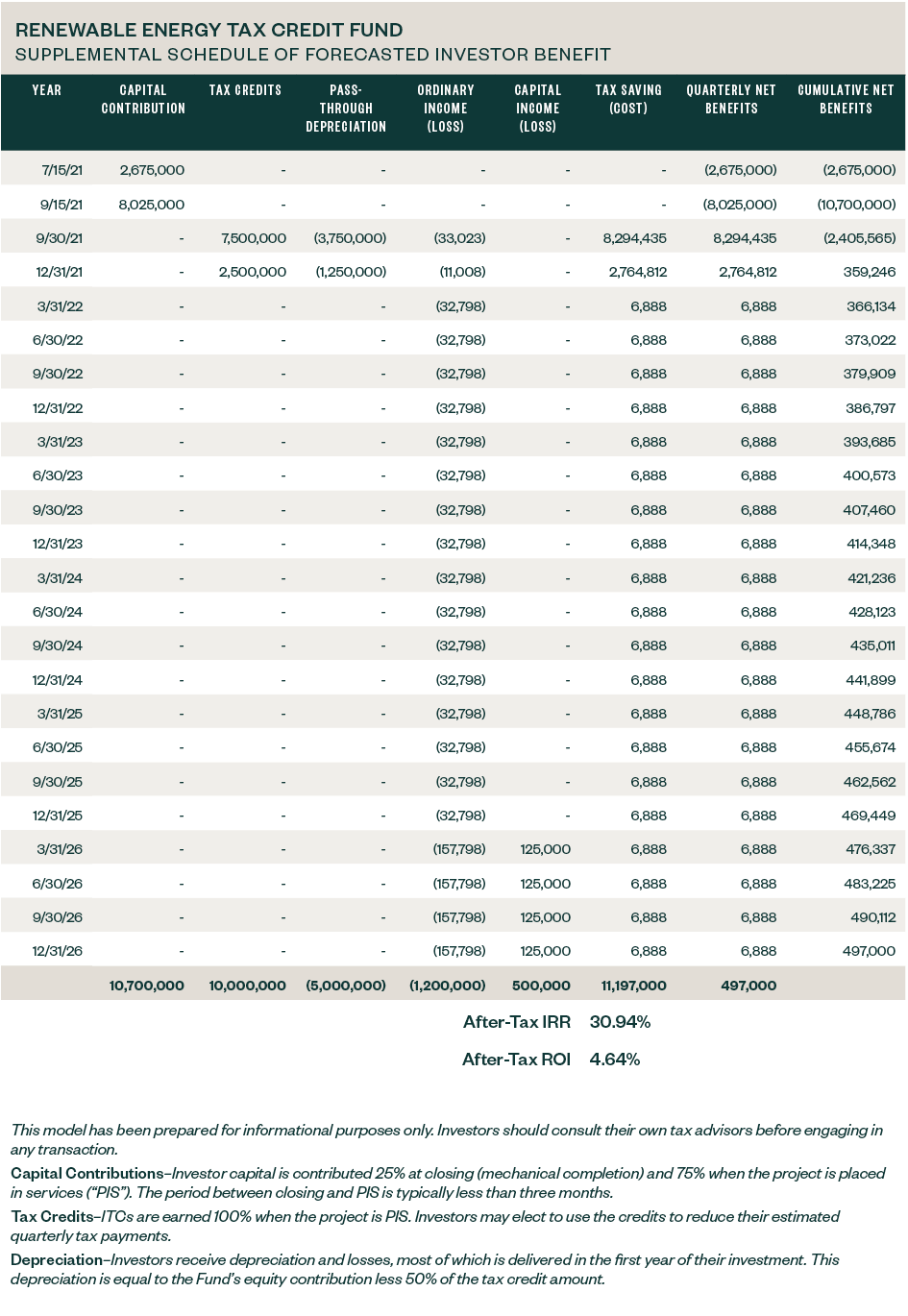

How To Acquire Federal Tax Credit Investments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

How To Acquire Federal Tax Credit Investments

Refundable Tax Credits Congressional Budget Office

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet